CSRD Explained

The Corporate Sustainability Reporting Directive came into force 1.1.2023, became applicable 1.1.2024, and amends the accounting directive 2013/34/EU. CSRD will strengthen and standardize the rules for how companies are required to disclose information on their impact on people and the planet.

CSRD will affect ca 50 000 companies operating in Europe after gradually increasing the reporting scope of the accounting directive from the current scope set by the non-financial reporting directive (NFRD). European Sustainability Reporting Standards (ESRS) are published under the CSRD, which companies are obliged to use for their reporting from FY 2024.

What is CSRD?

The Corporate sustainability reporting directive (EU) 2022/2464, or CSRD, replaces the non-financial reporting directive (NFRD, 2014/95/EU) amendment to the accounting directive (2013/34/EU). CSRD is one of the actions implemented under the EU Green Deal and the sustainable finance action plan and aims to foster transparency by strengthening sustainability reporting and accounting. Through this goal, the CSRD help investors to identify companies that are engaged in sustainable activities.

The CSRD further supports the EU Commission’s objective of ensuring An Economy that Works for People by enabling investors and other stakeholders to access comparable non-financial information from companies operating in EU/EEA. These goals are achieved by strengthening the rules on what social and environmental information companies must disclose and how they need to report on these topics.

In addition to defining mandatory reporting requirements, the CSRD also expands the scope of companies required to report on sustainability beyond the scope defined by the NFRD. The reporting scope has impact beyond CSRD by defining which companies need to report information according to the Taxonomy regulation as well.

📃📌 The first companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025. We provide more detail on the timeline below.

What is the purpose of the CSRD

💡 The ultimate purpose of the CSRD is to increase transparency on how companies work with sustainability related issues and to help companies to think of sustainability on a long-term time horizon.

The new rules will ensure that investors and other stakeholders have access to the information they need to 1) assess the impact of companies on people and the environment and 2) for investors to assess financial risks and opportunities arising from climate change and other sustainability issues. By defining European Sustainability Reporting Standards that companies need to report according to, and align those standards with the currently most used reporting initiatives, reporting costs are expected to be reduced for companies over the medium to long term by harmonising the information that needs to be provided.

CSRD impact on Business Strategy

Sustainability will have an increasing role in how companies do business. The reporting obligations set by the CSRD have implications beyond reporting alone. The new reporting obligations requires that sustainability is embedded in the long-term business model and strategy, and in the decision-making process of the management board and board of directors.

The implicated requirement to reduce environmental impact and promote social responsibility may even require changes in the company supply chains, in product design or marketing. Such a shift to integrate sustainability as a core business issue may also lead to organisational changes because the companies need robust reporting structures throughout their organisation.

🔎 The reporting obligations that create this change is, for example, the requirement to report on the company’s transition plan to ensure that the company’s business model and strategy are compatible with the transition to a sustainable economy. Or the need to report on how the internal control and risk management systems cover sustainability issues and associated decision-making process. Or lastly, the need to report on the role the management board and board of directors have in sustainability matters and their expertise and skills, or access to expertise and skills on those matters.

Benefits of CSRD

According to the European Commission, the CSRD improve the former legislation defined by NFRD by requiring more detailed information from companies’ impact on the environment, human rights and social standards, that are in line with the EU’s policy objectives set by the EU Green Deal and the EU commitments on climate and sustainability.

The benefits companies gain from adapting to CSRD include:

- standardised reporting on companies’ activities impacting people and the planet, therefore providing the opportunity to compare sustainability reports to one another.

- opportunity to direct finances and investments to activities and businesses that create a positive or ‘net-zero’ impact on the planet and people.

- CSRD pushes management to adapt or improve their strategies to be aligned with EU’s sustainability and climate goals.

- CSRD enforces companies’ capability to mitigate risks, such as climate risks that will help companies to ensure longevity.

Adapting to CSRD requirements as soon as possible is recommended, due to the vast scope of the directive and the increased amount of data that needs to be collected for CSRD reporting compared to previous.

The company’s starting point depends on the company’s status and maturity regarding sustainability matters and how well they are documented and reported in the past. Many companies will be reporting on sustainability for the first time in the coming years, and an early start will allow more time to build a coherent reporting system and to divide costs over a longer time span. The first step to establish the reporting system will be the double materiality assessment, which is the cornerstone of the sustainability reporting procedure.

Who are affected by the CSRD?

It is estimated that the CSRD will affect ca 50 000 companies in Europe, a substantially larger number of companies compared to the ca 11 700 companies affected by the sustainability reporting requirements set by the NFRD.

The CSRD sets mandatory sustainability reporting requirements for:

Large listed and non-listed companies

- with more than 250 employees,

- a balance sheet total of more than 25 million euros

- and more than 50 million euros in net turnover, on company or consolidated group level.

In addition, the requirements will affect listed small and medium enterprises, except for micro-companies.

Third-country companies

The requirements will affect third-country companies with a large or listed SME subsidiary in EU that have a combined annual revenue of more than 150 million euros. If a third-country company has a branch in EU not considered a subsidiary, the same reporting requirements apply, if the branch has generated more than 40 million euros the preceding financial year.

👀 A Wall Street Journal publication suggests that more than 10 000 non-EU companies will be affected by the CSRD, 31% US, 13% Canadian and 11% UK companies. A smaller fraction of companies from other companies will be affected, but overall companies from over 60 countries will be impacted by the reporting requirements.

CSRD Timeline, Requirements and Compliance

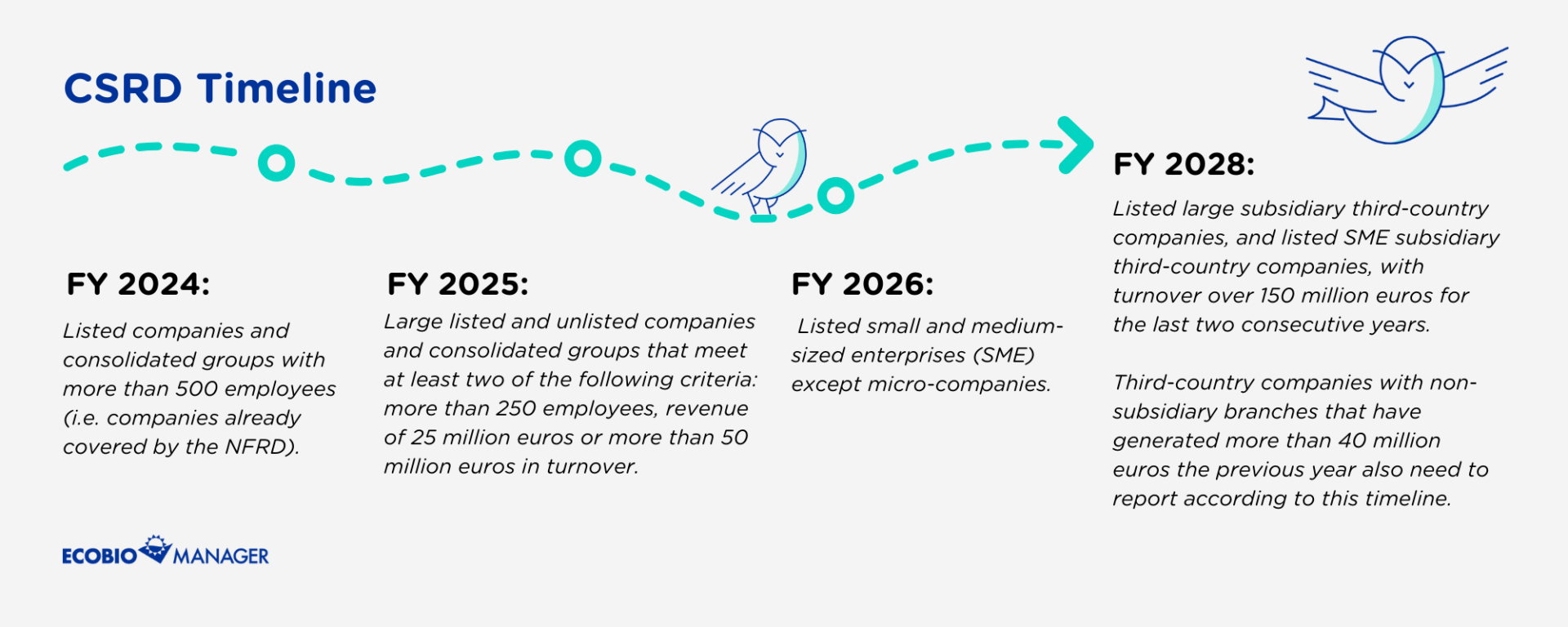

The Corporate Sustainability Reporting Directive applies to companies in the following order according to Article 5 of CSRD (EU) 2022/2464

- from financial year (FY) 2024, listed companies and consolidated groups with more than 500 employees (i.e. companies already covered by the NFRD);

- from FY 2025, large listed and unlisted companies and consolidated groups that meet at least two of the following criteria: more than 250 employees, revenue of 25 million euros or more than 50 million euros in turnover;

- from FY 2026, listed small and medium sized enterprises (SME) except micro-companies;

- from FY 2028, listed large subsidiary third-country companies, and listed SME subsidiary third-country companies, with turnover over 150 million euros for the last two consecutive years. Third-country companies with non-subsidiary branches that have generated more than 40 million euro the previous year also need to report according to this timeline.

CSRD requirements and compliance

CSRD requires all large companies and listed SME companies to disclose information on their identified risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.

CSRD expand the detail of reporting compared with the requirements defined under the NFRD. Furthermore, companies are required to report their sustainability information following the new European Sustainability Reporting Standards (ESRS). These standards define in more detail what companies need to report regarding their:

- governance relating to sustainability impacts, risks and opportunities

- impacts of sustainability-related risks and opportunities on the company’s strategy, business and financial planning

- processes for identifying and assessing sustainability impacts, risks and opportunities

- metrics and targets that are used to assess and manage sustainability risks and opportunities

The CSRD also defines a requirement that the sustainability information needs to be externally verified under limited assurance.

Double materiality under CSRD

The decision of what sustainability data companies need to collect and what topics to report on will be based on the company’s double materiality assesment. Traditionally, the assessment of material topics has focused on what impacts a company’s activities have on people and the planet.

💡 Under the CSRD, however, companies are required to base their material topics – or sustainability matters – on the double materiality principle. Conducting a double materiality assessment means that companies assess both the impact of a company on society and the environment (impact materiality) and the impact society and environment has on the company (financial materiality).

The inside-out perspective of impact materiality focuses on issues such as GHG emissions, waste management, occupational safety or human rights. The outside-in perspective of financial materiality focuses on risks and opportunities arising from issues such as regulatory changes, supply chain disruptions or reputational risks driven by for example climate and environmental change or from societal events such as wars, pandemics etc.

The underlying idea of double materiality is to provide a more holistic understanding of a company’s sustainability impacts, risks and opportunities.

The European Sustainability Reporting Standards (ESRS) and EFRAG

Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS), which aims to fulfil the purpose of CSRD to standardise sustainability reporting across EU. The standards were developed by the EFRAG, previously known as the European Financial Reporting Advisory Group, an independent body bringing together various stakeholders. The standards are tailored to EU policies, while building on and aligning with international sustainability reporting frameworks such as GRI, SASB and TCFD.

These mandatory reporting standards aim to ensure that companies are fully transparent about their impact on people and the environment and the risks and opportunities to the companies arising from sustainability issues. The standards will also be a key tool in trying to extinguish green washing. The new standards will assist companies in communicating and managing their sustainability performance more efficiently as well as providing investors with information necessary to make more informed decisions based on sustainability criteria.

The delegated act defining the ESRS were published in 22 December 2023 and applies from 1 January 2024 for financial years beginning on or after that date.

Embrace the challenges of CSRD with confidence!

Ecobio Manager acts as your trusted team mate, helping you to navigate the complex scenery of CSRD. To learn more on how Ecobio Manager can help you to handle CSRD with confidence, book a time with our team today!